Massive brands are fast embracing the multi-billion-dollar NFT market. But how are retailers using NFTs? What role will NFTs play in the future of retail? And where does the metaverse fit into all this? Discover the opportunities NFTs provide retailers and how major brands are using NFTs to drive sales and boost loyalty.

Gucci, Nike, Adidas, Walmart, and Gap are just a few of the hundreds of retail brands that’ve embraced the world of NFTs.

With a staggering $23 billion spent on NFTs in 2021, it’s no surprise why.

Commerce follows attention. It followed eyeballs from storefronts to highway billboards to TV to social media and the internet.

And with NFT sales soaring, Facebook changing it’s name to Meta, and NFTs being awarded the word of the year in 2021, retailers are betting on blockchain technology (NFTs) and the metaverse becoming a new locus of consumer attention.

But how are brands using NFTs? What role will NFTs play in the future of retail? And why are retailers using NFTs as their ticket into the metaverse?

Using dozens of NFT success stories and examples from across industries, this article covers all these questions and more. It explains how retailers can use NFTs and explores the exciting opportunities of NFTs for retailers.

Discover how your brand can use NFTs to:

1. Boost brand awareness

2. Build brand advocates & communities

3. Create new & unique brand experiences

4. Make your mark in the metaverse

5. Own your brand & capture control over resale

6. Drive new revenue streams

Don’t know anything about NFTs? Check out our NFTs explained for business blog before diving in.

At their most basic level, NFTs represent a marketing opportunity. We saw this during the initial NFT madness in March 2021, when brands from Taco Bell to Twitter to Pringles to Coca-Cola rolled out NFTs. These companies made headlines across the globe and inserted their names into the many discussions around the booming technology.

Think of these one-off NFT drops as the digital equivalent of releasing limited-edition merchandise or selling off an iconic product from your brand archive. The release can be entirely separate from your core product offering, but it still offers the opportunity to generate buzz, engage existing fans, and attract the attention of new ones.

For some brands, NFT launches are about much more than just inserting themselves into the weekly news cycle. These brands are looking to tap into the fast-growing NFT market and boost brand affinity and engagement among pre-established audience bases.

When Adidas announced it’s Into the Metaverse NFTs, they didn’t do it alone. They collaborated with some of the biggest NFT projects and influencers on the scene to create buzz among a curated audience and increase their reach. In Adidas’ own words, their collaboration was ”with the community, for the community.” These partnerships were key to adding legitimacy to their project, increasing its visibility, and boosting hype around the Into the Metaverse launch.

As brands releasing NFTs has become commonplace, more businesses are partnering with existing NFT projects and creators. This allows brands to enter the world of NFTs with an established customer base and the seal of approval from the big names in the space.

NFT brand partnership & collaboration examples

- Louis Vuitton collaborated with renowned NFT artist Beeple for their NFT video game

- Shopify worked with NFT project Doodles to promote it’s NFT selling platform

- Nike acquired large NFT sneaker brand RTFKT to tap into the NFT market

- Gucci worked with NFT artist Superplastic for their NFT release

- Visa announced its commitment to NFTs with the high-profile purchase of a CryptoPunk

- Puma partnered with four cat-themed NFT projects for their foray into NFTs

Think of these partnerships like a sponsorship deal with an athlete, musician or influencer. It’s big brands tapping into the passionate audiences of NFT artists, creators, and influencers to increase their reach.

RELATED: 9 Steps for a Successful NFT Drop: Hype, Fairness & Fun

Brands that commit to going beyond the one-off NFT drop have an even greater opportunity than just brand awareness. NFTs create the potential to foster brand advocates and communities.

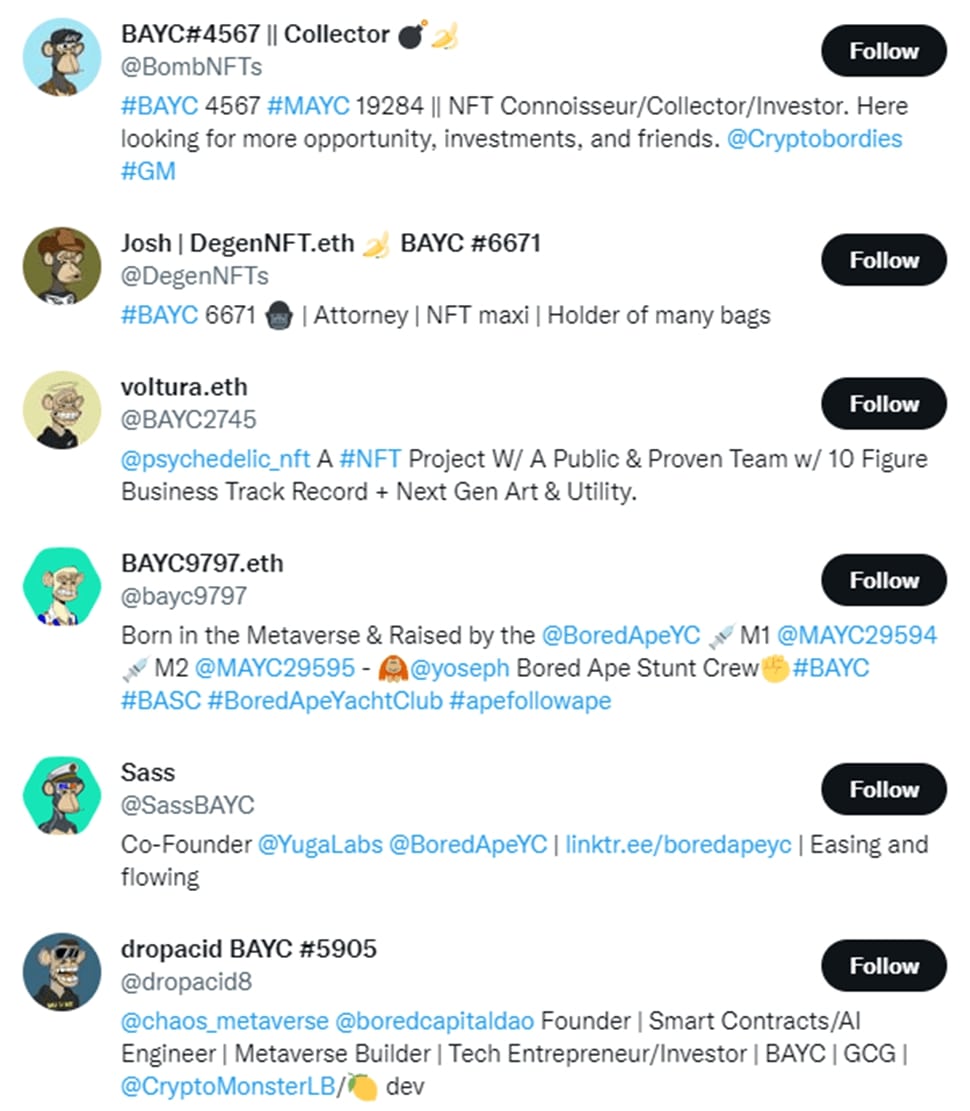

Pick any mid-sized NFT collection and take a quick look on Twitter and you’ll see NFT buyers are among the most vocal and community-oriented customers out there.

Thousands of Twitter users make their NFTs their profile pictures. They connect and follow one another. They retweet and like announcements from creators and community members. They voluntarily promote the project they’ve bought into and become loud brand advocates.

There’s several reasons NFTs create brand advocates. But one of the biggest is that NFTs as an asset class incentivize self-promotion and community-building.

NFT collections represent both an investment and a membership to an exclusive club of owners. And the more desirable membership to that club becomes, the more highly valued the investment becomes.

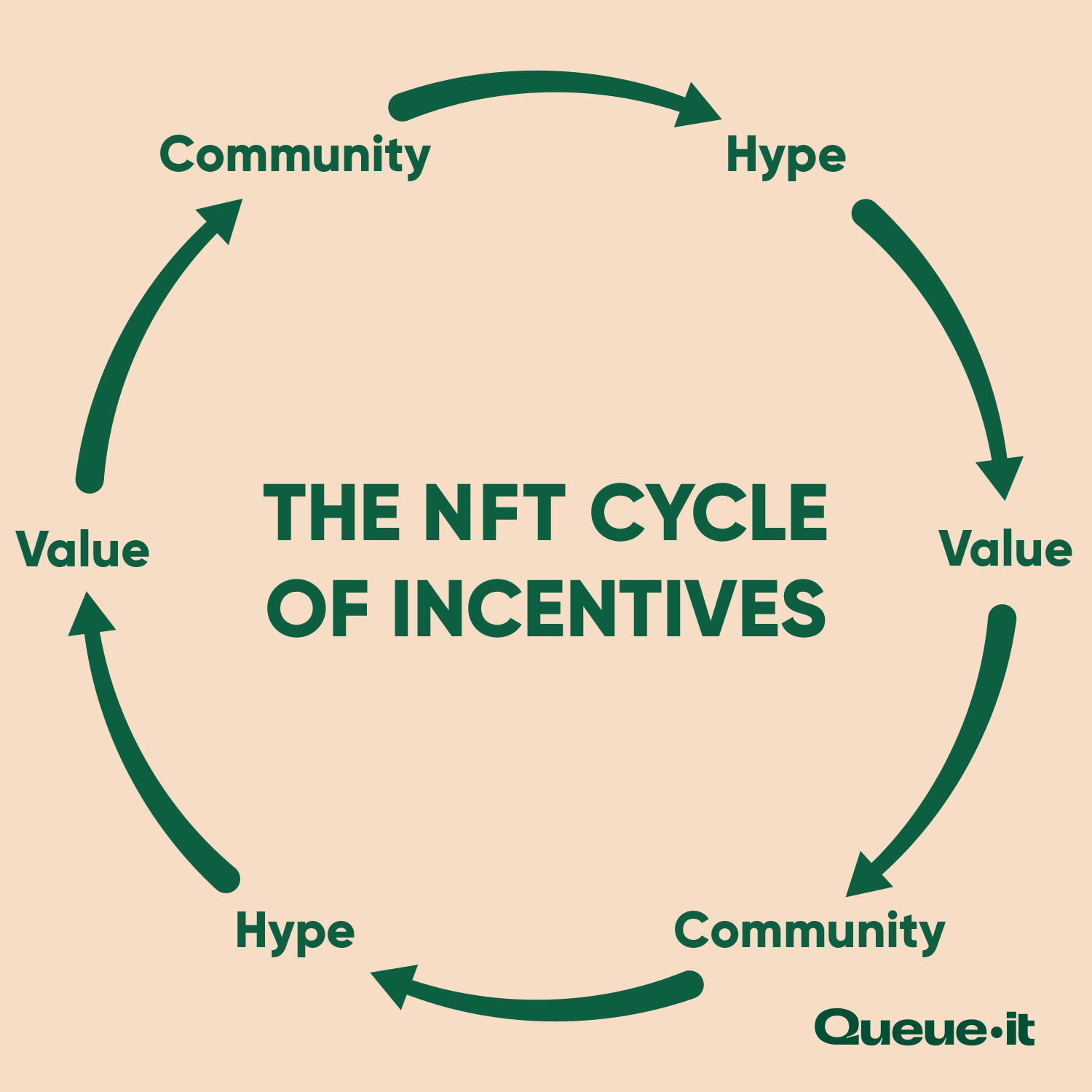

This creates a powerful cycle of incentives.

Take the Bored Ape Yacht Club NFTs as an example. The first 10,000 BAYC NFTs were offered for a couple hundred dollars each (0.08 ETH).

The initial buyers were extremely passionate about the project. They changed their profile pictures, Tweeted about it, followed other ”Apes”, and built both private and public communities around the NFT collection. Just tweeting #NewProfilePic or #ApeFollowApe along with a picture of your BAYC NFT would attract thousands of followers and conversations.

As others became interested in the project and existing owners decided they weren’t willing to give up their membership cheap, the price of the BAYC NFTs rose.

As the price rose, those who didn’t care enough about the project sold their NFTs at a profit, allowing new members to buy in at a higher price. Of course, these new members believed in the project, so they became fervent advocates of it and the price rose again.

Today BAYC owners include Steph Curry, Jimmy Fallon, Mark Cuban, Serena Williams, Justin Bieber, and Gwyneth Paltrow. The price of admission to the exclusive community, now filled with celebrities, has risen to a staggering $300,000 (current BAYC floor price).

As you can see, the hype and community drove the increase in value, which drove more hype and community, which drove more value, which...you get it.

It’s a speculative market, but the market makers aren’t on Wall Street pulling the strings. They’re on Twitter, Instagram, and Discord. NFT customers are incentivized to do what marketing teams spend millions on: boost the visibility, desirability, and level of engagement with the brand.

When done right, NFTs offer the opportunity to turn fans into brand advocates, and to let those fans benefit from raising the profile of your project and your brand. It’s the decentralization crypto enthusiasts are passionate about creating a new form of community-driven marketing.

Many NFT companies have already shown this powerful cycle of incentives can work, which is why retailers, enterprises, and marketers are looking for their ticket in.

Hear from NFT company Nifty's VP of Marketing Jimmy Mouton the importance of community for their brand in this clip from our joint webinar on how major brands use NFTs to drive sales & boost loyalty.

We’re in an experience economy. Two-thirds of companies now compete based on customer experience and over $84 billion was spent globally on experiential marketing in the year before the pandemic hit.

Traditional advertising is fatiguing consumers. Brands understand this and are working to engage customers through unique and exciting digital experiences.

NFTs offer brands new opportunities to engage and delight customers and fans.

These opportunities include not just the cycle of community and hype mentioned above, but using NFTs as unique forms of merchandise, collectibles, and experiences.

Franchises like Disney, Warner Bros., and the NBA have already had massive success using NFTs to boost their brand. And others are looking for their angle in.

Let’s look at just a few of the many ways brands are creating unique experiences for fans with NFTs.

Unique brand experiences powered by NFTs

The release of Warner Bros. The Matrix Resurrections film was accompanied by a launch of 100,000 Matrix NFTs. Buyers of the NFTs got their own randomly generated avatars and could choose whether to transform them with the red pill or keep them as they were with the blue pill. Owners could compete in games as their avatars and climb leaderboards to become “The One.”

The Matrix NFT drop was so hyped that over 300,000 users queued in a virtual waiting room for a chance to get their hands on these NFTs. The sale netted $5 million for Warner Bros. and NFT marketplace Nifty’s, while giving 100,000 fans of The Matrix a new way to experience the brand.

You’re probably thinking, ”It’s easy for a film franchise like The Matrix to do this. But it’s different for retailers and legacy brands.”

Consider then Louis Vuitton’s NFT-powered brand experience. To celebrate the brand’s 200th year, Louis Vuitton created an entire video game filled with their iconic brand imagery and motifs. They hid 30 limited-edition NFTs throughout the game for fans to discover and win. In their first week, the app saw half a million downloads.

Other innovative brand experiences powered by NFTs include:

- DC Comics giving free NFTs to every fan who registered to join their DC FanDome event

- Selfridges selling physical Paco Rabanne art pieces along with NFTs in store

- Coca-Cola hosting a party in the Decentraland Metaverse and selling virtual apparel as NFTs

- Burberry creating an NFT collection buyers can use in the game Blankos Block Party

- Disney releasing “Blind box” Pixar Pal NFTs, where users get random NFTs of Pixar’s most iconic characters

Each of these examples lets fans engage with brands in new and exciting ways. They’re all highly aligned with these brands’ stories and imagery and serve only to boost affinity and loyalty among customers.

But the next frontier for brand experiences and sales may take place somewhere else entirely: the metaverse

RELATED: 11 Exciting NFT Trends Shaping the Future of Non-Fungible Tokens

If you were to take a walk through the streets of the Sandbox metaverse, you’d find land owned by Warner Music, Adidas, Gucci, even financial institution HSBC.

What’re they all doing there?

They’re taking a bet on where attention is moving.

Gartner predicts the global metaverse market will hit nearly $42 billion by 2026, and 25% of people will spend an hour a day in the metaverse by then. Active metaverse users increased 10x between 2020 and June 2021, and those numbers are only set to rise.

And while cryptocurrencies are the frontrunners for the currency of the metaverse, NFTs have emerged as the products that these currencies are spent on.

For brands, NFT products are their ticket into this rapidly growing market.

You can buy a block of land (as an NFT) in a metaverse and make it your digital flagship store. You can sell clothing and accessories as NFTs to players of the game, so they can walk around wearing your items. You can host invitation-only events that can be accessed by holders of your NFTs. You can build unique games and challenges that connect users with your brand.

Maybe this all sounds crazy, but it’s already happening.

Let’s look at how.

Generate hype, deliver fairness & set your NFT project up for success with your free 8-step interactive NFT drop checklist

Brands making their mark in the metaverse

On Gucci’s 100th anniversary, the brand entered the metaverse with the Gucci Garden on Roblox, a metaverse video game. The garden attracted a massive 19 million visitors. It celebrated Gucci’s history, allowing visitors to walk through ad campaigns and exhibitions. Gucci also let visitors purchase and wear exclusive virtual items, which owners could take beyond the experience and wear during regular Roblox gameplay. While these products weren’t NFTs, they worked in the same way to generate hype and revenue.

Nike’s NIKELAND in Roblox has over 12 million visits. Users can play games and complete challenges there. They also give out free (virtual) branded hats and backpacks, and sell virtual sneakers.

Warner Music Group bought a massive concert venue as an NFT on Sandbox. Before you roll your eyes at the idea of virtual concerts, consider a virtual Travis Scott concert on Fortnite attracted 27.7 million unique players to attend—making it the biggest concert ever. If virtual events like this continue to grow in popularity, Warner’s NFT purchase has secured a place to host artists, sell merchandise, and bring fans together.

Offices are opening up in the metaverse, with Vice Media Group and crypto companies Binance and FTX buying property where their staff can meet and collaborate.

In the U.S., Decentraland users can even walk into a virtual Dominos store and order a real-world pizza.

Samsung unveiled its new Galaxy S22 phone in Decentraland, with over 100,000 users attending the launch. They let users buy phones in the metaverse and offered collectible NFT badges and Samsung merchandise.

These companies are all following the millions of consumers who are spending more time and more money in digital worlds than ever before.

Can yours afford to miss out?

“All consumer products—that can’t be eaten—in the next 10 years will have digital twins. They will have NFTs,”

This is the bold claim of Tether co-founder William Quigley.

So what’s a digital twin and what does it have to do with retailers and NFTs?

A digital twin, or a product passport, is a digital copy of a physical product or asset. Essentially it allows for a digital record of ownership of physical assets.

Big brands have spent decades fighting counterfeit goods. But with counterfeiters only getting more sophisticated and prolific, it’s largely a losing battle.

Fakes are all around us. In 2019, trade in fake goods made up 3.3% of total world trade. A recent report found that up to 20% of all paintings owned by museums may be inauthentic. In the sneaker space, the issue is so large that StockX, a sneaker verification and resale platform, is valued at almost $4 billion.

Aaron Aguliar, brand protection manager for UL, told the New York Times:

“The quality of counterfeit products has greatly improved from what they used to be, and in virtually every industry you can think of. If you can make a dollar, then a counterfeiter is going to find a way to exploit that demand.”

The history and authenticity of a real-world item is always uncertain, especially when purchased from resellers. Sure, the new shoes you bought on eBay look like Nikes, but if you’re not buying them directly from Nike, how can you be certain?

In short, it’s constantly getting harder to tell real assets from fake ones.

Digital twin NFTs and product passports help solve this problem. What’s more, they offer retailers the opportunity to tap into the growing resale market and better understand resale trends.

With digital twin NFTs, physical items would be linked to a NFT and stored on a decentralized blockchain that’s near impossible to manipulate.

Again, the NFTs aren’t the physical items, but a tool for verification of those items. Think of it like a receipt or a certificate of authenticity that is secured, publicly accessible, and holds the full history of the item.

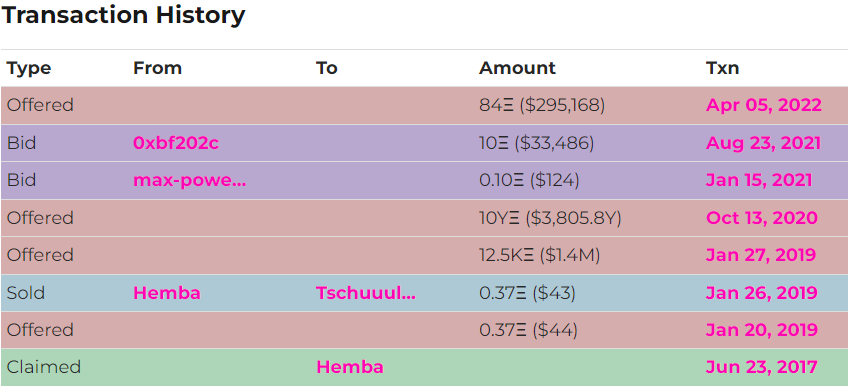

Below is the full transaction history of the NFT CryptoPunk 3348. We can see who the first owner is, who has made offers on it, and the one lucky person who bought it second-hand for $43 in 2019.

Imagine this same type of record existing for physical items. It would completely change resale markets.

There’s a dual benefit at play here: you’re not only cutting counterfeiters out of the equation, you’re also opening the doors to the previously untapped data resource that is a product’s full lifecycle.

For most brands, the product journey is complete after a purchase. There may be some requests for feedback or monitoring of complaints and repurchasing, but most brands know very little about what happens after a purchase is complete.

With digital twin NFTs, you can access a digital record of all sales and transfers of ownership. Your brand could monitor demand on the secondary market to see if a product is worth re-releasing. You could collate items that are rapidly dropping in value and assess why. You could track how long an item is typically held and understand whether products are being bought for use or for resale purposes.

What’s more, customers could purchase with confidence of authenticity. They could see when the product was produced, how many people have owned it, and what its price history is.

There’s even the opportunity to write a royalties function into the smart contract of NFTs, letting your business to take a percentage of all secondary sales. While you might expect customers to be dismayed by a royalties fee, consider the fact that verification services and marketplaces like StockX are booming, and they’re taking a 10% cut of every sale.

LVMH, Prada, and Cartier have already partnered on their own bespoke blockchain, Aura, which is used to tokenize ownership over real-world luxury goods. They’re betting big on NFTs with Aura, and the service may soon replace the current standard of certificates of authenticity.

Nike has even patented its own blockchain based system of verification, called CryptoKicks.

Of course, resale marketplaces fear retailers taking this power into their own hands. StockX is already trying to get ahead of the potential for brands to implement NFTs by creating their own. They’re currently selling NFTs of verified sneakers and collectibles.

The resale market is booming and is predicted to reach $57 billion by 2025. Implementing NFTs not only lets retailers get their cut of this market, but it also makes it a safer place for consumers, who can buy on the resale market with confidence the products are legitimate.

Beyond all the sentiments about awareness, engagement, and loyalty, NFTs can offer something very tangible—new revenue streams for retailers. NFT sales are unlikely to surpass traditional sales, but they’re still a growing market and an enormous industry.

Alongside the massive marketing value, Adidas’ NFT sale gave them $22 million in revenue. NBA Top Shot generated over $700 million in total sales in less than a year. RTFKT, which was bought by Nike, sold over $3.1 million in virtual sneakers in just seven minutes. Disney sold over 50,000 Pixar Pal NFTs, making a cool $3.3 million off the release.

In a very simple sense, NFTs empower businesses to expand their product offering while reinforcing their brand. They create the opportunity for an entirely new revenue stream.

What’s more, they offer something called granular price tiering.

Granular price tiering is a method of sales where sellers segment the pricing of their products or services to match a variety of target markets.

Luxury brands are experts at using granular price tiering.

Buying a Chanel jacket will cost you almost $10,000. Few can afford to spend that kind of money on a jacket and the price and quality of the garment exude luxury and exclusivity. Middle-class people who want their taste of this luxury can buy Chanel sunglasses, which cost a more modest $400. Or perhaps a fragrance, which, better still, will only set you back $130. And in the handbags of people across the globe, you’ll find $50 Chanel concealer.

The exorbitant prices of Chanel's garments help them maintain their brand image of luxury and exclusivity. But they can’t be too exclusive, otherwise they’d price-out too large a portion of the population.

They instead use granular price tiering to give more customers more opportunity to buy-in on their promise of luxury.

The same is being done with NFTs.

NFTs are relatively cheap to produce, can be made in whatever quantity you choose, and can be sold without the necessity of manufacturing or shipping. What this means is that pricing is entirely up to you.

On NBA Top Shot, basketball fans can buy a $200,000 Lebron James dunk NFT or spend $2 on a Daniel Thies dunk NFT. Beeple sold a $69 million NFT at auction, but he also released 105 NFTs for sale for just $1 each—of course, this sale quickly crashed the MakersPlace website. Maybe customers can’t afford a Burberry trench coat, but their $300 NFT avatars and $100 NFT Jet packs sold out in seconds.

All these examples show that with NFTs, the producers can pick the price. You could turn the same artwork or piece of clothing into an NFT and sell 100,000 of them for $1 each, sell 1,000 for $100 each, or sell just one of them for $100,000.

The item is digital, so production and distribution costs barely rise with scale.

Brands can give millions of customers a unique product and brand experience at a low price. In this way, there’s nothing quite like NFTs.

In the Nike and Gucci metaverse examples above, both brands are both selling and giving out free virtual merchandise. They can give out millions of branded caps and armbands that will be worn around the Roblox world, with little-to-no additional overhead.

This lets the brands create important touchpoints with consumers at a low cost. Today’s young gamers are tomorrow’s retail shoppers. And if you’ve spent hours playing video games with your virtual avatar wearing Nike apparel, which brand will you think of next time you need sneakers?

The early days of NFTs are often compared to the early days of the Web. In the late 90s, the world was rife with predictions about the future of the Web and ecommerce. Many believed websites would be the future of everything. Others labelled tech stocks overvalued and the techno-optimism misguided.

Both groups had it right, sort of.

From the rubble of the Dot Com Bubble crash emerged the tech companies that now dominate our world. Google, Amazon, eBay, and other internet-based companies have grown to staggering heights.

If the analogy isn’t already obvious, many see cryptocurrencies and NFTs as fated for this same life cycle. It has all the same qualities.

There’s the same fanaticism on one side and skepticism from the other.

There’s the same massive valuations of NFT series and staggering plummets of others.

There’s the same true technologists excited by the potential of NFTs, and scammers looking to make a quick buck.

And there’s the same scrambling of corporations to integrate blockchain technology and create NFTs as there were with websites in the late 90s.

While this analogy creates fear for many—the Dot Com Bubble lost investors a lot of money and saw many companies shut down—it creates great excitement for others. It tells a tale of possibility. It recreates the excitement that buzzed around Silicon Valley in garages and start-up offices.

In 2013, angel investor and software developer Chris Dixon wrote an article called “What the smartest people do on the weekend is what everyone else will do during the week in ten years”.

He mentions Bitcoin, which at the time was worth about $150 (current price over $40k); the Internet of Things, a then niche area which McKinsey estimates drove $1.6 trillion in economic value in 2020; and 3D printing, a then $4.4 billion industry which ballooned to $16 billion in 2021.

While few of us spend our weekdays trading Bitcoin, 3D printing, or developing the Internet of Things, it’s safe to say Dixon’s article has prescience.

What’s Dixon working on now? You guessed it: NFTs and blockchain tech.

What the smartest people do on the weekends has spawned whole industries. This was true for the early Web. It was true for Web 2.0 and ecommerce. The question is whether it’ll be true for Web 3.0 and NFTs.

And whether it’s a chance your business is willing to miss.